Machine Learning Value Investor

By Wyatt | May 1, 2024

Below is the culmination of my machine learning value investing work over the past 2 year or so. If you find the information here interesting and would like to learn more, please reach out to me at wyatt@terrapenecapital.com. I'll send over a more in-depth overview. We'll be in touch.

Model Backtesting Performance

5/7/2021 - 12/27/2024

When backtesting on individual stock data the models have never seen before (very important to prevent overfitting), it did the following over ~3.5 years:

320.91%

Model Live Results

Around May 1st 2025, we completed a long arc of model development and backtesting. During this period, we had a paradigm shift in model architecture, base LLMs, model ensembles, data sources, and much more. The results:

May 1st, 2025 - September 23th, 2025

95.38%

These models are getting better every day too.

Disclaimer

I'm a goofball. I do not have the market solved. I'm not a fortune teller. These models consistently show substantial market outperformance; however, there is no guarantee that the future will be as bright. Okay, now that that is out of the way.

S-W-A

Warren Buffett, during the 1999 shareholder meeting, was questioned about how he could achieve an annual return of over 50% with a small capital base. His response was to "Just start with A."

What he meant by this is that he'd start at the beginning of the Moody's Manual and go through all the businesses listed in the book.

He was trying to convey that an exceptional investor needs to look at everything. "The person that turns over the most rocks wins the game" - Peter Lynch

This inspired the beginning of my work. Imagine having a set of machine learning models capable of doing the same work in under 10 seconds, rather than an individual or a large investment team painstakingly analyzing each investment opportunity.

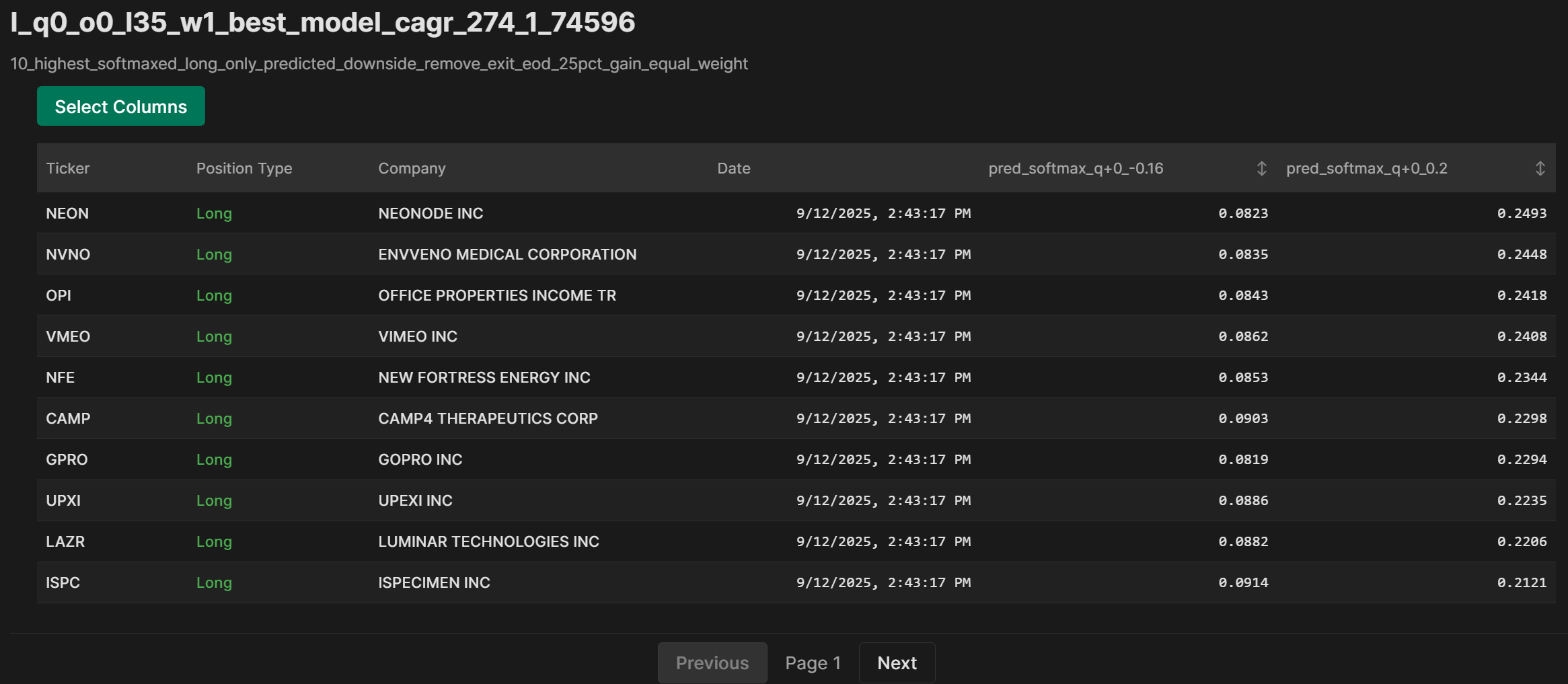

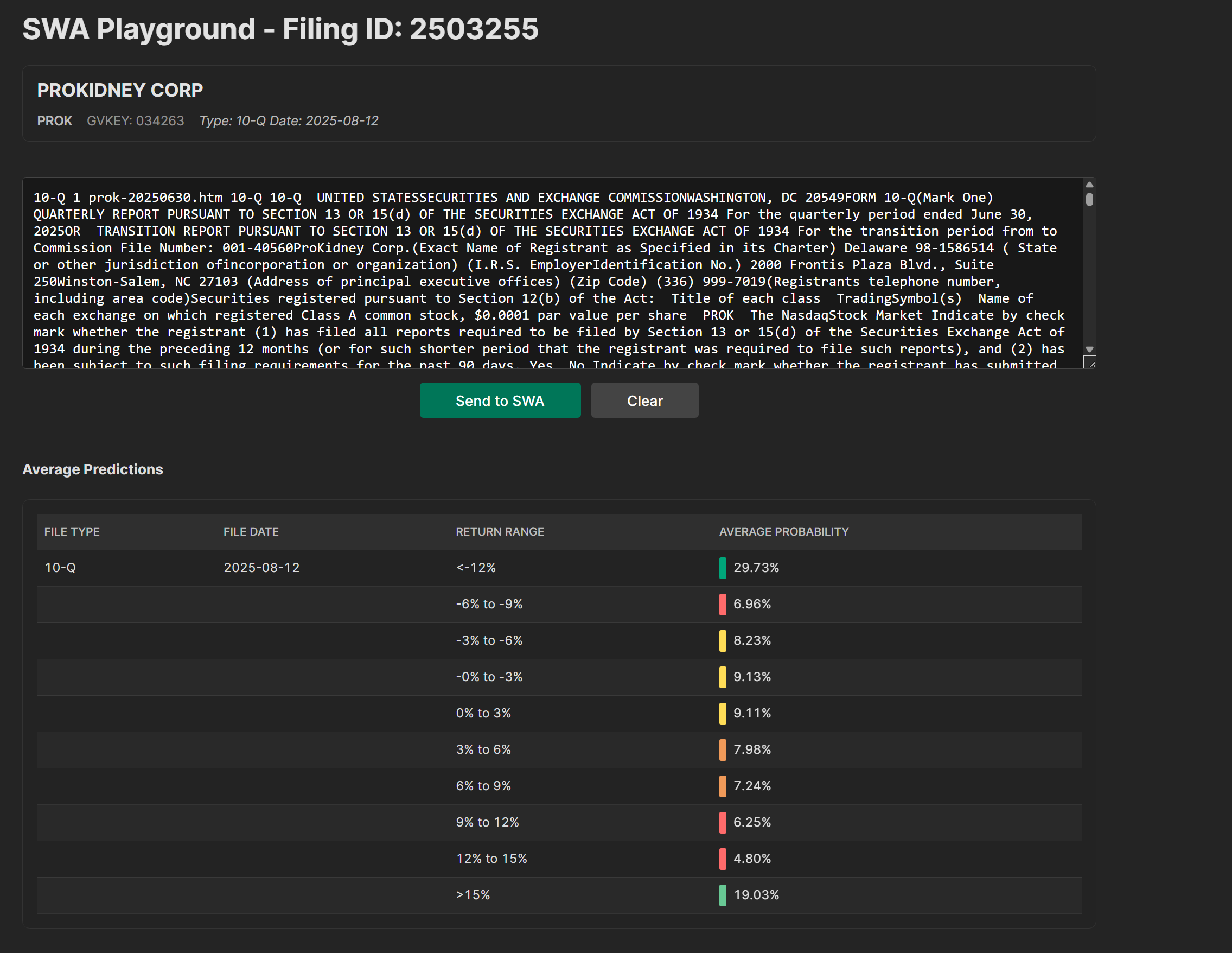

With the advent of new machine learning language architectures, we have a system that has read every 10-K, 10-Q, and 8-K to have ever been filed.

With the advancements in computing, we have a system that has examined every financial result from every North American public company.

Preview of full paper

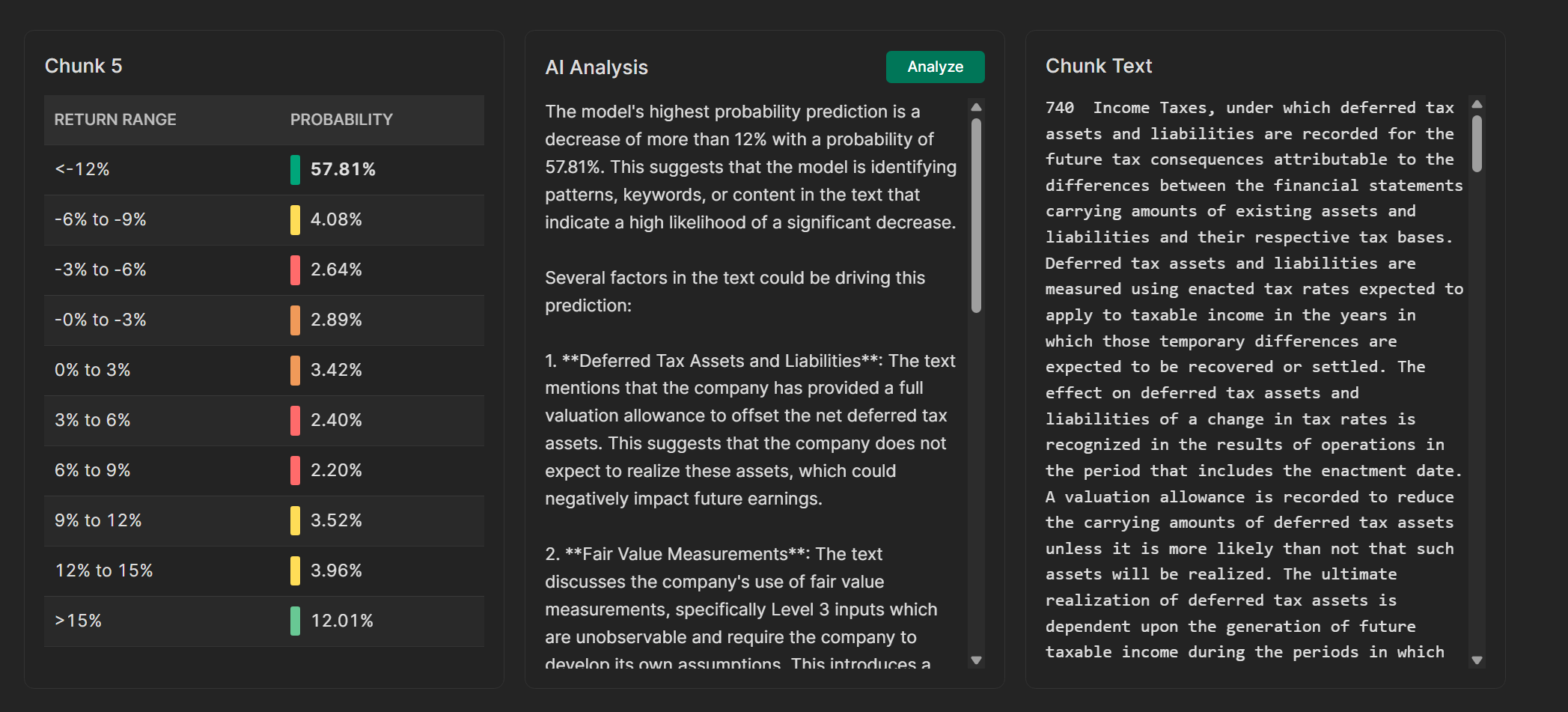

This paper presents a framework integrating a few machine learning techniques with traditional value investing principles to enhance stock selection processes and narrow investors' search space to opportunities most likely to provide market-beating returns. Central to our approach are two models: the QFig model, which analyzes quarterly financial data alongside selected macroeconomic indicators to predict stocks' price appreciation or depreciation, and the SWA model, which employs a Transformer architecture to assess the qualitative content of 10-K filings for future price movement insights. The paper delves into the development and training of these models, discussing the data acquisition from various external sources, data preparation, and the rationale behind choosing specific machine learning architectures.

In evaluating the effectiveness of our models, we explore their backtesting performance across various time frames, highlighting their ability to significantly outperform market averages. Notably, the models demonstrate unique strengths in identifying both long and short investment opportunities, with particular success in scenarios traditionally challenging for value investors, such as periods of high market volatility or anomalous market behavior.

Further, we address the conceptual underpinnings of value investing as outlined by Graham and Dodd, juxtaposing these with the capabilities of modern machine learning techniques. While market price fluctuations offer a limited view of risk, as traditionally critiqued by value investing philosophy, machine learning models can capitalize on these fluctuations to identify mispriced assets, thereby realigning investment decisions closer to the fundamentals of value investing.

Additionally, we acknowledge the limitations of these models, especially when applied by firms with larger assets under management (AUM), due to potential scalability issues and the challenge of maintaining high returns as the investment base grows. Creative solutions to these limitations are proposed, including model adjustments and the strategic limitation of investment size in individual positions to preserve the models' efficacy at larger scales.

This comprehensive examination not only bridges the gap between value investing and machine learning but also extends an invitation to investment practitioners to consider how these advanced models can refine and augment their investment strategies in pursuit of superior returns.